How Taxes Work

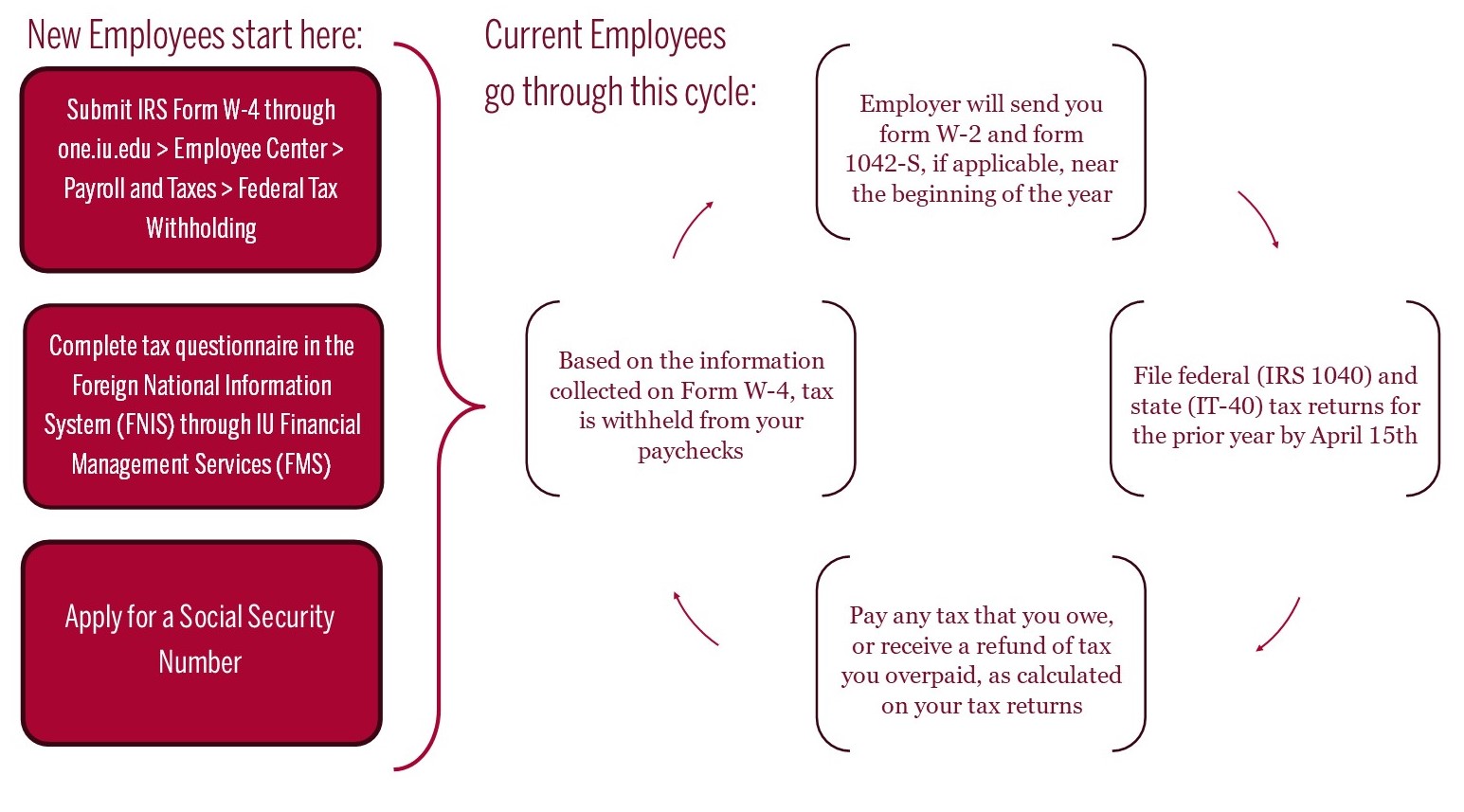

The Tax Cycle in the U.S.

This cycle only begins once you have actually arrived in the U.S. You cannot complete the W-4 and I-9 forms referenced below if you are outside of the U.S.

Information about filling the FNIS questionnaire can be found here.

For further information on the annual tax cycle please review the information below.

When You Are Hired Complete These Governmental Forms

W-4:

This is a form used by your employer to determine the amount of taxes to withhold from your paycheck. As an IUPUI employee, your employing department will ask you to complete Form W-4 for both the federal government and the Indiana State government. Generally, if you are a non-resident for tax purposes, you can only claim one exemption—yourself—on both of these forms. Once you have become a resident for tax purposes, then you may be able to change your W-4 withholding. (To do this, you will need to complete the International Tax Questionnaire again or arrange a meeting with the tax office.)

I-9:

This form verifies the identity and employment authorization of individuals hired for employment in the United States. Your employing department will need to see the documents authorizing your employment. The Human Resources representative in your department will assist you in this process.

If You Are In a Non-Immigrant Status Complete This Form

FNIS (Foreign National Information System)

If you are an international employee at IUPUI, you need to go online and complete information in the FNIS system. Based on the information you submit, the Tax Office—FMS may be in contact with you and request further information.

If you have further questions about this system, please contact FMS at taxpayer@iu.edu and give them your name and university id number.

If You Qualify for a Tax Treaty Complete Form 8233

8233:

If you are a nonresident for tax purposes, you may use this form to claim an exemption from withholding on compensation because of an income tax treaty. If you are eligible, FMS will prepare this form and send it to you for your signature.

If you are Employed Apply for a Social Security Number

You may begin working as long as you have a job offer and the appropriate employment authorization. To receive payment for your work, you will need to apply for a Social Security Number (SSN) through the U.S. Social Security Administration (SSA). Learn more »

You Will Receive These Forms from the University Tax Office

Between January and March, you will receive tax statements from Indiana University (Financial Management Services) which detail how much you have received as earnings and how much you paid in taxes for the previous calendar year.

W-2:

This is a form that details compensation you received through employment and provides information on taxes withheld by the government. You need this form to prepare your tax return each year.

1042-S:

This is a form that details compensation you received through employment and provides information on taxes withheld by the government. You need this form to prepare your tax return each year.

Review Information for Filing Your Tax Returns

The Office of International Affairs has many resources to assist international students and scholars with the filing of their annual tax returns.

Please note some things have changed since last year. There is no personal exemption so all of your U.S. income is taxable. However some of the tax brackets decreased. This has more implications if you made little U.S. income. Also only residents of Canada, Mexico, Korea and students from India may be able to claim their children as dependents.